GRASIM AT A GLANCE

Grasim Industries Limited, a flagship Company of Aditya Birla Group (ABG), is one of the leading diversified companies in India. Grasim is a prominent producer of Cellulosic Staple Fibre (CSF), globally and in India. CSF is a subset of global markets of man-made textile fibres. Also, we are one of the India's largest manufacturer of Chlor-Alkali and Speciality Chemicals (Epoxy Polymers and Curing Agents). Through our subsidiaries, UltraTech Cement, Aditya Birla Capital and Aditya Birla Renewables, we are also India's premier cement producer, one of the leading diversified financial services player and a clean energy solutions provider, respectively. We also have significant presence in Sustainable Textiles such as Linen & Cotton Fabrics and Woolen Yarn. We have entered into two high growth businesses namely Paints and B2B E-commerce for Construction Materials.

Read More Legacy Of LeadershipFINANCIAL HIGHLIGHTS

` 1,52,876crore

Market

capitalisation*

` 1,30,978crore

Consolidated

revenue

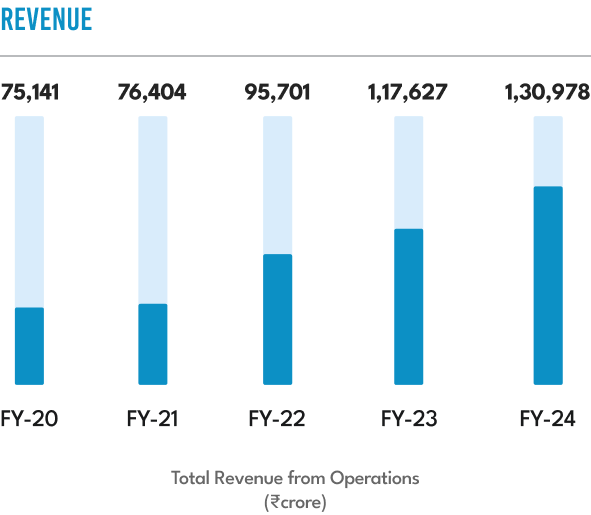

` 20,837crore

Consolidated

EBITDA

NON-FINANCIAL HIGHLIGHTS

45,929

Total

workforce

11%

Renewable

power share

7.5 lakh+

Trees planted

(cumulative)

*As on 31st March 2024

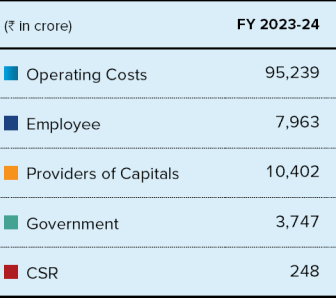

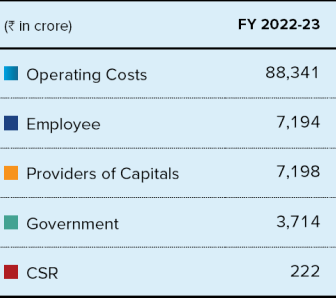

ECONOMIC VALUE DISTRIBUTED

` 1,32,243crore

Economic Value Generated

` 1,17,599crore

Economic Value Distributed

` 1,21,239crore

Economic Value Generated

` 1,06,669crore

Economic Value Distributed

BUSINESSES

DRIVING DIVERSE OPPORTUNITIES

Our business segments enhance our competitive edge, fostering resilience, and driving innovation, all within the framework of our overarching corporate goals.

- CELLULOSIC FIBRES

- CHEMICALS

- BUILDING MATERIALS

- FINANCIAL SERVICES

- OTHERS

CELLULOSIC FIBRES

CELLULOSIC FIBRES

With a total global scale capacity of 842 KTPA of Cellulosic Staple Fibre (CSF) we are a significant player in the man-made textile fibres industry. Through indigenously developed second and third generation fibres, like Birla Modal and Birla Excel (Lyocell), we have pioneered CSF market in India with high-quality, eco-friendly products.

810KT

Highest-ever CSF sales volumes

67%

EBITDA growth YoY

CHEMICALS

CHEMICALS

Our Chemicals business encompasses three categories: Chlor-Alkali, Chlorine Derivatives, and Speciality Chemicals. We are the premier manufacturer of caustic soda in India, with a capacity of 1,359 KTPA, and produce a range of Chlorine Derivatives used in industries such as water treatment, plastics, and pharmaceuticals.

1205KT

Highest-ever caustic sales volume

62%

Chlorine Integration

BUILDING MATERIALS

FINANCIAL SERVICES

FINANCIAL SERVICES

Aditya Birla Capital Limited (ABCL), Grasim's financial services arm, offers a suite of financial products across financing, protecting, investing and advisory services. With omni-channel architecture, ABCL provides customers complete flexibility to choose their channel of interaction. Digital presence includes platforms like ABCD Application and Udyog Plus.

`4,36,442crore

Assets Under Management

`34,008crore

Total Revenue

OTHERS

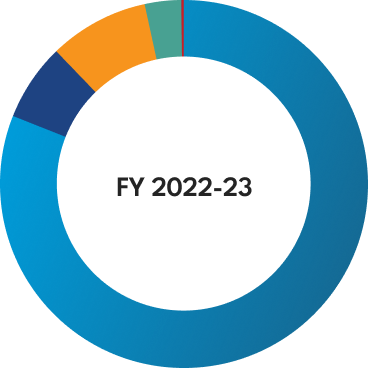

Track record of consistent Growth

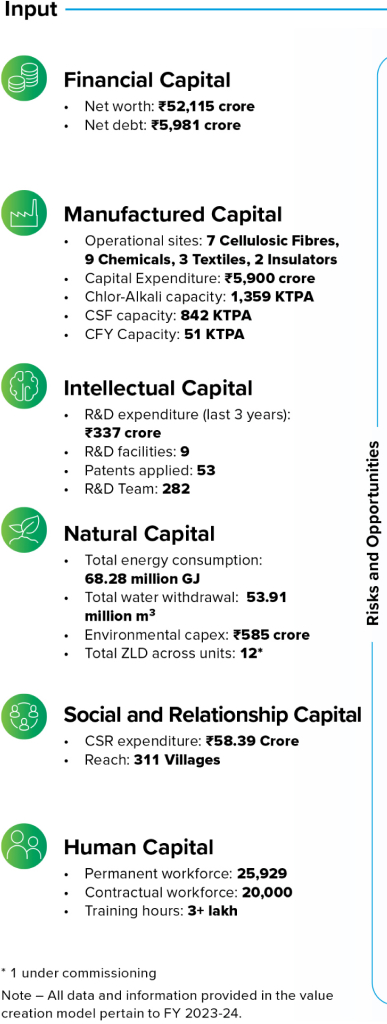

OUR APPROACH TO VALUE CREATION

CAPITAL-WISE HIGHLIGHTS

CREATING VALUE ACROSS DIMENSIONS

Business success hinges on multiple foundational elements that empower an organisation to reach its goals. We recognise that sustainability and long-term viability stem from effectively leveraging the six capitals

Read MoreSTRATEGIC PRIORITIES

DESIGNING OUR PATH TO EXCELLENCE

Our strategic priorities are defined with the aim to drive our organisation towards sustained growth.

- Leadership across businesses

- Innovation

- Sustainability

- Capital Allocation

- Cost Leadership

Our approach to sustainability

RISK MANAGEMENT

FORTIFYING THE FUTURE

WITH FORESIGHT

As a diversified conglomerate with a diverse risk portfolio, we are guided by the principle of being ‘Predictive, Proactive and Prepared’.

Read MoreSUSTAINABILITY FRAMEWORK

PROGRESSING WITH PURPOSE

Pillar 1

Environmental

Stewardship

Pillar 2

Social

Responsibility

Pillar 3

Resilient Business

Responsibility

CORPORATE GOVERNANCE

LEADING WITH EXCELLENCE

AWARDS AND RATINGS

PERFORMING WITH CONVICTION